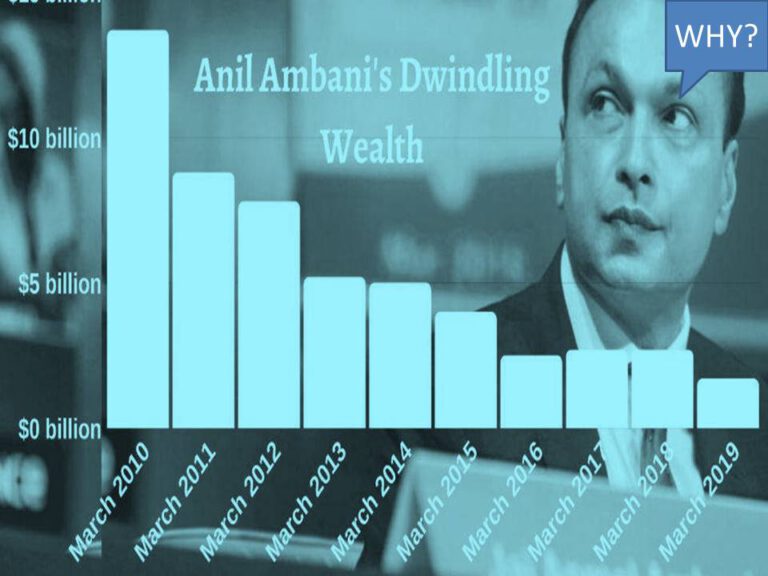

Expression of Interest (EoI’s) for sale of Anil Ambani companies (Trouble mounts for ADAG)

Lenders of Reliance Naval and Engineering Ltd have sought expressions of interest (EoIs) from buyers to acquire the bankrupt shipbuilder under the insolvency and bankruptcy code.

The second Anil Ambani-controlled Reliance Group firm to go for insolvency after Reliance Communications Ltd, Reliance Naval now admitted for insolvency proceedings on 15 January by the Ahmedabad bench of the National Company Law Tribunal. It is after the IDBI Bank first dragged Reliance Naval to the bankruptcy court 16 months ago. The bank had claimed dues worth Rs1,159.43 crore.

Reliance Naval has defaulted on loans worth Rs9,492 crore, the company disclosed to stock exchanges in January.

The last date for submitting EoIs is set at 27 June, while the final list of prospective resolution applicants will be issued on 17 July.

The last date for submission of the resolution plan is 6 August, and the plan is expected to be submitted to the bankruptcy court for approval on 5 September, according to a notice published the company’s resolution professional.

In its 2019 annual report, the company said it was facing an acute cash flow crunch, affecting the progress of its existing projects leading to extended timelines and erosion of confidence amongst clients. “This lack of new orders has led to the significant reduction in the Company’s current level of operations as compared to its capacity,” it said.

Earlier known as Pipavav Defence & Offshore Engineering, Reliance Naval has been facing severe financial headwinds since 2013. It was bought over by Anil Ambani group in 2015.

A 23 May Bloomberg report said Anil Ambani was ordered by a London judge to pay more than $700 million to a trio of Chinese banks following a dispute over defaulted loans. The tycoon, who has said his net worth is “zero“, has 21 days to make the payment.

The group has recently put up its Delhi electricity distribution businesses for sale, having previously sold its Mumbai electricity distribution arm to the Adani group.

*image source from Google

Check More News on World Economy: