Gulf Oil Producer Oman Is Quickly Running Out Of Options

Even before the latest Saudi-instigated oil war crashed oil prices, Oman had a budget breakeven price per barrel of Brent of over US$85, with a senior legal source in Abu Dhabi focusing on the oil industry spoken to by OilPrice.com at that time stating that the Sultanate needed at least US$7 billion very quickly to avoid extremely negative financial consequences. Given the twin facts that Oman only has around five billion barrels of estimated proved oil reserves (barely the 22nd largest in the world) but is still dependent on the hydrocarbons sector for over 80 percent of its national budget revenues, the recent relatively moderate rebound in oil prices has done little to alleviate Oman’s perilous economic position. Last week’s downgrading of Oman by a global rating agency, Moody’s Investors Service, to Ba3 – three levels down into non-investment (junk) status – after S&P Global Ratings’ downgrade in March (to BB-, with a negative outlook) has further narrowed the re-financing options for the Sultanate, leaving it ‘examining all options, however unpalatable’, according to the legal source in Abu Dhabi.

On the expenditure side of Oman’s government balance sheet, much had already been done to reduce costs in the aftermath of the first Saudi-led oil price war beginning in 2014 and lasting for two years. So determined was Oman to keep its fiscal deficit within manageable proportions, that not only did it implement measures – including lower expenditure on wages and benefits, subsidies, defense, and capital investment by civil ministries – that reduced expenditure (in 2016 by around 8 percent of GDP) but also moved to rein-in hydrocarbons-related spending as well. In this context, the Sultanate’s Financial Affairs and Energy Resources Council formed a specialized working group to study public spending and the means by which to reduce it. At the same time, it was made clear that the Omani government would apply zero-based budgeting in the ninth five-year plan of approving allocations for development projects only after all feasibility studies and real cost analysis of each of them had been completed. The Council also underlined that it aimed to avoid having any additional requests for funding from developers after any project had been started.

These measures were geared towards safeguarding the US$7 billion emergency figure but more dramatic measures are now being considered in light of the additional negative hit to Oman’s finances that resulted from the latest oil price war. One of these, according to various reports out of Oman last week, is a re-examination of the costs to the Sultanate of the planned gas-to-liquids (GTL) project with Royal Dutch Shell (Shell) and French major Total. Given that the cost of Shell’s Pearl GTL plant in Qatar trebled from US$6bn to US$18.5 billion between the go-ahead being granted for the project in 2006 and its completion five years later in 2011, Oman’s concerns over ballooning costs appear well-founded. “The starting costs figure is way more than the Pearl plant – US$19 billion – so if that triples as it did for Qatar, the financial ramifications for Oman would be catastrophic,” the Abu Dhabi source told OilPrice.com last week. According to Oman’s Undersecretary of Ministry of Oil and Gas, Salim al-Aufi: “We’ve decided to revisit the GTL with our partners Shell,… and will see what is best for the project, and this work could take up to three months… So, by the third or fourth quarter, we will make a final investment decision of some kind on the project.”

On the income side of the Oman government’s balance sheet, the recent downgrades by Moody’s and S&P will certainly result in pushing the borrowing costs for Oman further out and have constrained the likely take-up by many foreign investors for conventional bonds offerings from the Sultanate. However, the relatively close-knit community of investors in Islamic bonds (sukuk) is still open for business. Given that sukuk under Shari’ah law should avoid investment in activities that are deemed speculative, involve uncertainty, pay interest, are unjust to participants, or are connected to prohibited businesses (such as gambling, alcohol, and the sale of certain foodstuffs), such bonds are always of great appeal to investors in Islamic countries. Additionally, though, as these bonds are underpinned by tangible assets and the notion that both the issuer and investor share both risk and return – and are consequently broadly regarded as inherently ‘less risky’ than conventional bond offerings even from the same issuer – they also have seen their appeal rise in countries with sizeable Islamic communities, especially after the great financial crisis. Indeed, this sukuk-buying community has expanded to include the U.K. (the first Western country to issue a sukuk), through Germany and Turkey (key European hubs for sukuk) to Malaysia (the biggest sukuk center in the world).

Although Oman’s tentative plans for a conventional bond offering may or may not now go ahead on schedule, its plans to issue sukuk are likely to remain relatively unaffected. According to London-based banking sources close to Oman’s Ministry of Finance, these decisions will be made very shortly, with a major sukuk offering leading off a series of similar offerings announcements across the curve. “It [Oman’s Debt Management Office] is also looking to change the balance of the loan portfolio, pushing out tenors, and checking the prospects for more syndicated loans further out and at better pricing,” one of the sources told OilPrice.com last week. “Oman is not a bad prospect, as it has always been good at taking control of its exposures and working with the limited resources in terms of oil and gas that it has,” he added. In broad terms, at the beginning of this year, S&P Global stated that it expected the sukuk market’s strong performance in the past few years to continue in 2020, with an estimated total sukuk issuance of around US$170 billion in 2020, including US$40-45 billion of foreign currency issuance, representing 5 percent growth compared to the US$162 billion issued last year.

Having said all of this, it may be that Oman has little choice as well except to push forward with its increasing engagement with the self-styled ‘savior’ of all financially troubled Middle Eastern states – at least those that are required in either the land or sea elements of its ‘One Belt One Road’ project (OBOR) – China. In the hydrocarbons sector alone, Chinese demand accounts for around 85 percent of all Oman’s oil and condensate output, and this monetary infusion has been leveraged into a broader on-the-ground presence. Aside from pledging support for Oman’s multi-facetted petrochemicals sector development plans, centered around Duqm, China has also pledged US$10 billion in the first instance into the broader Duqm area via a land lease agreement. The focus initially will be on completing the Duqm refinery but the package will include a product export terminal in Duqm Port and Duqm refinery-dedicated crude storage tanks in Ras Markaz.

In addition to these, the Chinese money will go towards the construction and building of an 11.72 square kilometer industrial park in Duqm in three areas – heavy industrial, light industrial, and mixed-use. According to the plans, all of which will be ready within the next 10 years, according to Beijing, in the light industrial zone there will be 12 projects, including the production of 1 gigawatt (GW) of solar power units, and of oil and gas tools, pipelines and drilling equipment. The mixed-use sector will focus on projects designed to improve the infrastructure for Omanis, including the construction of a US$100 million to build a hospital, and a US$15 million school. The heavy industry sector will also see 12 projects, dealing with the production of methanol and other chemicals.

A fascinating (or worrying, depending on who you are) tangential project – which also neatly ties in China’s land element of its OBOR to its maritime element – is the use of Oman’s ‘spare’ Liquefied natural gas (LNG) by Iran, as part of its objective of becoming a global LNG player. In 2013, the legal foundation for oil and gas cooperation between Iran and Oman was laid, with the signing of a deal based on Iran supplying Oman with at least 28 million cubic meters per year for a minimum period of 15 years. “This would easily allow for the gas – and a lot more – to be sent to Oman, with some being used by Oman itself and the rest being turned into LNG by the Oman LNG plant in Qalhat for Iran, whereupon it would be shipped off to wherever Iran wanted it to go,” a senior oil and gas industry source who works closely with Iran’s Petroleum Ministry told OilPrice.com last week. Indeed, after the ‘Joint Comprehensive Plan of Action was implemented in 2016, the plan had been for a 400-kilometer land-sea pipeline running from Iran to Oman to be completed within 30 months. This would have comprised a 200-kilometer landline from Rudan to Mobarak Mount in the southern Hormuzgan province, and another 200-kilometer pipeline running on the seabed between Iran and Sohar Port in Oman. Alireza Kameli, the managing director of the National Iranian Gas Company, at the time stated that about 23 percent of Oman’s LNG production capacity remains unused, which Iran would utilize under the agreement, paying Oman a commission for processing the gas into LNG form.

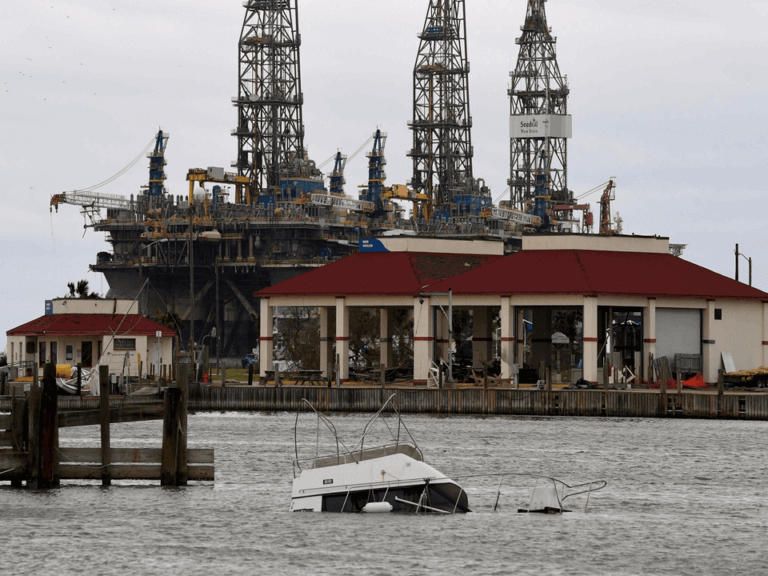

*image source from Google

Check More News on World Economy:

INDIA’S STRATEGIC CRUDE OIL RESERVE TO BE FULL BY MID-MAY SAYS DHARMENDRA PRADHAN

Please help us by sharing it.