Bank statement – All you need to know

What is a bank statement?

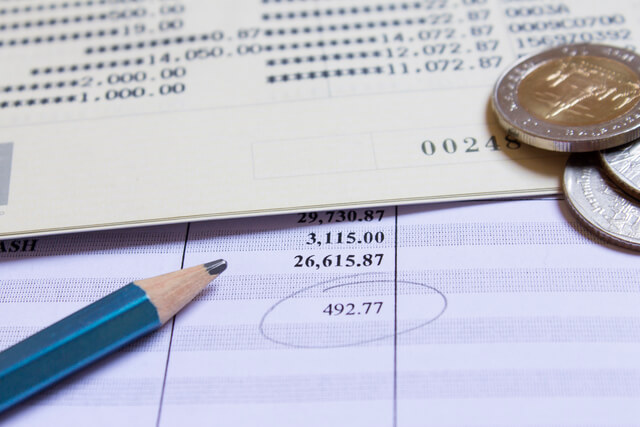

A bank statement is a summary of various transactions that were processed by a bank in your account during a set period of the month. The bank statement describes your bank details, charges, deposits, withdrawals, and deductions, with the account holder’s name and account number.

Bank statements also demonstrate the opening balance of accounts and closing balances too.

Bank statements are generally generated by banks and various financial institutions every month to deliver their customer’s or account holders’ records of their overall financials.

Persons having a checking or savings account in a bank can access these bank statements online by visiting the website of bank or via logging into their net banking portal.

It is always suggested to review your bank statements weekly as checking the it can prevent fraudulent activities and also make sure that they don’t end up paying exorbitant banking fees for account maintenance.

How does a bank statement work?

A bank statement works in the following manner.

A bank or financial institution issues a bank statement to an account holder that shows the detailed activity that occurred in the account. It allows an account holder to see all the transactions processed on their account in a period of time.

Banks generally send monthly statements to an account holder on a set date. However, you can access a bank statement at any time you want. Apart from that, transactions on it typically appear in chronological order.

Special Considerations

Most banks offer their account holders the option of receiving paper statements and using paperless, electronic ones, usually delivered via email.

The electronic version of a bank statement through email is named an electronic statement or e-statement that allows their account holders to access their statements online where they can download or print them.

Some banks send email statements to their customers as an attachment. The automatic teller machines (ATMs) of some banks also offer the option to print a summarized version of a bank statement, which is named as transaction history.

Even with the convenience, value, and accessibility of e-mail statements, the charm of paper statements isn’t likely to go away anytime soon as In 2021, more than 7% of adults in the U.S. reported that they do not use the internet, as per the research made by Pew Research Center.

A survey done by Two Sides North America in 2017 demonstrates that nearly 70% of consumers find it easier to track expenses and manage finances with paper statements rather than e-statements. Two-thirds of the individuals prefer a combination of paper and electronic statements.

Most of the recipients of e-statements still print out their statements at home, preferring to keep a permanent record of their statements.

What does a bank statement contain?

It usually contains three parts:

- The details of the account holder

- Account Details

- Transaction history

The details of the account holders are mentioned at the top of the account statement. The Account holder’s details include the Name, registered mobile number, and residential address of the account holder.

After the details of an account holder, an account summary is presented which holds the account number, home address, account description (type of account), and other details of the account holder.

The details of the transactions demonstrate all the transactions recorded with the appropriate date, amount, and description of the payee or payer.

A customer has the access to choose the statement period for which he/she wants the bank statement.

For eg: A customer has the option to get the account statement for the complete financial year or choose to get the account statement for a period of one month or the statement period of the last three months or any specific range of days.

Various banks offer various statement periods. So a customer can choose the statement period that he/she needs according to his/her requirement.

Features of bank statement

Monitor account balance

A bank statement helps the account holder to keep track of his/her expenses and transactions (debit and credit). It helps the customer to become aware of his money and manages his/her finance accordingly.

Fee and Interest Tracking

If a bank or credit union or financial institution is giving interest on the deposits, one can know how much money is being made on their savings every month. Depending on the interest earned by the saved money, one may make some strategy to put some of the money in an investment account or money market to earn more.

Identify fraud

A bank statement allows one account holder to review his/her statements regularly to help spot any fraudulent activity, like if someone else is using the debit card etc.

Benefits of bank statements

Bank statements are generally used to show different account activities and ensure that there are no mismatches in credit and debit amounts in accounts.

Here is a list of different benefits offered to account holders who choose to view their bank statements online or by generating paper statements.

Avoids financial frauds

Bank statements come with a print of withdrawal and deposit amount that a specific account process every month.

Different Intelligent document processing solutions are used by banks to enlist financials on these records that help users to identify if there are any mismatches or discrepancies in amounts.

So with its help, you can compare the transactions recorded by the bank to your own personal records of transactions and use them to find financial fraud.

If there are no mismatches between your own record and bank statement then the records are accurate and validated.

Reduces accounting errors

Manual data entry of financial statements is prone to human error. However, electronic bank statements are more reliable in this regard.

Various automated bank extract statement solutions are used by different organizations to extract financial statements automatically, validate, verify, and input them in records.

It shows that nowadays users don’t need to worry about mistyped amounts, missing values, or different accounting errors done by humans as the entire process of extracting data from bank statements, reading, and recording transactions are now automated.

Documented AI software is used by different banks for this purpose, which is also fast, accurate, and reliable.

Shows account balances, penalties, and settlements

One of the greater advantages of reviewing bank statements by users is that they can get a complete list of their transactions done in the past.

Users can now review their account balances, penalties, charges, and settlements, by reviewing it.

Individuals can also learn how their money is flowing in and out of their accounts. The users aren’t taken by surprise of different hidden charges and they are also made aware of unauthorized transactions. This makes managing their bank accounts much easier and hassle-free without any problems.

How to access bank statements?

In the early days, statements were sent to customers by the bank via post, which sometimes incurred a small service charge. But now, with the digital revolution, most of banks have a digital presence, and electronic statements are commonly used.

E-statements are a convenient way to view the account activity of the users within a seconds without the messy paperwork, and your financial data is securely stored as well.

Sometimes certain banks also let you opt-in to receive emails with your statements attached. So you can view your it directly via your online account or smartphone app.

Getting Bank Statements online

Account holders can also get paperless account statements virtually via their mobile banking apps or net banking portals. Whereas some banks allow their users to download their bank statements as PDFs, some other banks email account bank statements to the account holders for downloading.

Here’s a detailed procedure we have generated for you to avail your bank statement online:

- Log in to your online bank account either using a mobile banking app of your respective bank or a net banking portal.

- Click on the option of “bank statements” or “e-statements” in your account and enter the statement period.

- After that, you will either get an option of downloading your bank account statement as PDF format or else you will get an email that contains your account statement on your registered email address.

Getting Bank Statements Offline

Bank statements can also be received via post after visiting the respective bank branch and filling out a request letter for your bank statement.

Paper bank statements are generally sent through the mail. Otherwise, in offline mode, a bank passbook is provided in their banking kit by the bank.

You can also record the offline bank statement in the bank passbook by visiting your respective bank branch and getting it updated. Your bank passbook will consist of all the transactions that you have made in an account printed on the paper of the passbook.

But most banks, financial institutions, and credit unions are now offering account holders the option of receiving a paperless electronic statement through their online bank account.

No matter if you are getting a physical or electronic copy of your bank statement, it is the same document with the same information. So as long as your bank offers you statements in both mediums, the option of your acceptance is a matter of personal preference.

Conclusion

As you read the article this far, you might have cleared all your queries regarding bank statements.

If you want to obtain your bank statement, no matter the option you choose, you can get all your information in your hand in a short period of time.

*image source from Google

Check More News on World Economy: