Trade in Rupee: An initiative by India to Enroute the Rupee into Global Trade

An initiative by India is taken to incorporate the Indian rupee into global trade.

But why and how?

Let’s dive into the blog below to find out.

Why does India want to trade in the rupee?

The rupee’s value against the American dollar is continuously sliding and it also flows from the periodic rise in the bank rates of the US. So it is a cause for national concern and ringing warning bells for our country.

The continuous increase in dollar rates and decrease in the rupee affects the common man the most. India imports a greater amount of days and grams, that reach the common man’s dining table as much as that of the rich. Along with that cooking mediums such as palm, and olein are also mostly imported. Most of the trading is generally done through the American dollar.

But nowadays, most of the nation is experiencing trading in and through the American dollar as an economic burden. The US also using it dollar as a geopolitical and geostrategic weapon, although not necessarily targeting all the affected nations.

For these multiple purposes, It is evident that trading in the Indian rupee may become an economic compulsion for India.

So India is in talks with about a number of smaller countries as the government of the country seeks to expand bilateral trades through rupee accounts and internationalize indigenous payment modes in rupee.

The objective of trading in the rupee is to bypass the dollar-denominated trades through small steps and the creation of an alternative payment ecosystem rather than the global SWIFT platform.

Way it would work

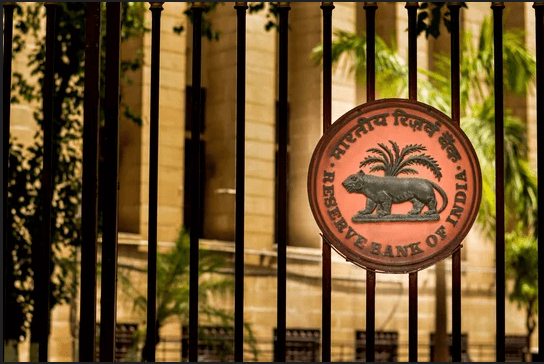

The Reserve Bank of India (RBI) has put in a mechanism in order to facilitate international trading in rupees (INR), with immediate effect. However, such transactions would take place through banks that will act as authorized dealers and the trader would have to take prior approval from the regulator to facilitate this process.

To initiate trading transactions with any country, any trader needs to open a Vostro account with the correspondent bank of the partner country for trading in the banks. Indian importers can pay for their import things in INR into these accounts. The earnings that the bank from imports can be then used to pay Indian exporters in INR.

Basically, a Vostro account is a bank account that is held by a correspondent bank on behalf of another bank. for example, the HSBC Vostro account is an international trading account held by SBI in India.

Current system

Currently, exports or imports of a company are always organized in a foreign currency, with exceptions like Nepal and Bhutan. So, in the case of imports, the Indian companies are paying in a foreign currency, which is basically in dollars, but it also might be pounds, euros, yen, etc.

The Indian companies are getting their payment in foreign currency in case of exports and they have to convert that foreign currency to rupee as they require the rupee for their requirements in most cases.

Expected use

While the RBI order did not clarify the expected use of these accounts, the arrangement was meant to be primarily used by Russia. There are sanctions on Russia post the Ukraine war and the country is of the SWIFT system which refers to a system used by banks for payments in foreign currency.

It suggests that the payments do not need to be done in foreign currency and this arrangement would be beneficial for both Russia and India.

It doesn’t mean that this arrangement is specifically for India and it was not likely that the arrangement would be extended to any other countries. India may want to pay in rupee but other countries may not accept it as they may require foreign currency to pay for their own imports. Sri Lanka may also want India to pay in dollars or any other foreign currency.

It has just started with Russia and all exports and imports under this arrangement may be denominated and invoiced in rupee (INR) further. However, the exchange rate between the currencies of any two trading partner countries may be determined by the market.

Countries India is dealing with

India has started its trading in the rupee with Russia. Apart from it, it is in talks with African countries like Djibouti, Zimbabwe, Malawi, Ethiopia, and Sudan.

India imports cereals, sugar, and plastic products as a part of the country’s trade with Djibouti. Such tradings, if routed through any kind of dedicated rupee account, can be settled in local currencies. The franc of Djibouti is equal to about half a rupee.

Just like that, India traded with Ethiopia, Namibia, Cuba, and Kenya which could be directly settled in Indian rupees apart from birrs, Namibian dollars, pesos, and shillings, respectively.

Sudan is a country that imports various pharmaceutical products and confectionery among other items from India, which could settle payments directly through rupees against its pound.

While the payment settlement mechanism is being fast-tracked, it has likely to be slipped into the slow lane with Sri Lanka due to various turmoil there. India specifically trades with Bangladesh in multiple items that include food, oil seeds, and garments. However, payment could be settled between these two countries in rupees and the Bangladeshi taka may be capped at Rs 5 lakh amid apprehensions of possible misuse.

As we discussed earlier, India had done rupee-rouble trade with the erstwhile Soviet Union and Russia. It also has rupee trade with Iran after the sanction of America in the relatively recent past. At present, India is trying to consider rupee-based trade with Russia, Iran, Saudi Arabia, and the UAE.

Various neighbors of India like Maldives and Sri Lanka, too, have long been asked by India for bilateral trade. However, they are looking at food as a ‘South Asian currency’ or the use of the Indian rupee for their trade purposes with third nations.

View of different Indian organization

Although trading in the rupee with Russia has started and India is in talks with some other small countries, The Reserve Bank of India (RBI), finance ministry, and National Payment Corp. of India (NPCI) did not comment anything on the matter.

The Indian Economic Trade Organization (IETO) and NPCI are generally engaged in such cross-border dialogue before it approaches the regulators. IETO held a conference for all Common Market for Madagascar, Eastern and Southern Africa (Comesa) ambassadors in Hyderabad last week. Various Senior ministries of external affairs and the government officials of Telangana were present.

As per Asif Iqbal, the president of IETO, India is engaging itself with a group of smaller countries that may be interested in bilateral trade via a dedicated rupee account. India is also helping smaller countries to kickstart bilateral talks after which they can together make a pitch for the UPI payment system involving NPCI. Such small steps will help the rupee to achieve international clout gradually through non-dollar bilateral trades.

The RBI and NPCI will be involved later in this matter for sorting out the exchange rate and various other payment technicalities once strategic partnerships between these countries are agreed upon.

Benefits and threats for India

India’s move to trade in the rupee could marginally narrow the widening trade deficit of India by reducing the price of commodity imports. According to different analysts Noting that is imports of crude oil from Russia have surged in recent months.

But according to different government officials, India would move cautiously on this matter internationalizing the local currency or trading in the rupee given the associated risks for the economy, such as higher exposure to global shocks, asset bubbles, and exchange rate volatility.

Conclusion

As you have read the whole article, you might get a grasp on the whole matter.

India has taken a great initiative by trading in the rupee or internationalizing the local currency which will help us to build its currency and economy in the future however it may drag some international problems to itself.

Let us know your view on this matter.

*image source from Google

Check More News on World Economy: